Some Known Incorrect Statements About Tulsa Bankruptcy Filing Assistance

Some Known Incorrect Statements About Tulsa Bankruptcy Filing Assistance

Blog Article

Little Known Questions About Top-rated Bankruptcy Attorney Tulsa Ok.

You can keep your home or auto as long as you're existing on the payments, can continue making settlements after the personal bankruptcy instance, and can spare the quantity of equity you have in the property. Learn what occurs to cars and trucks in Phase 7 personal bankruptcy. Phase 7 functions quite possibly for many individuals, particularly those who have little residential or commercial property, have predominately bank card balances, medical bills, personal fundings, and various other financial debts that obtain erased in insolvency.

Her state's median earnings for a single person is $65,000, so Helen won't pass the first part of the Chapter 7 means examination. Helen will certainly deduct actual and allowed costs in the 2nd part of the methods examination and pass if the calculation shows that she doesn't have additional funds to pay lenders.

The Experienced Bankruptcy Lawyer Tulsa Statements

If you applied for Chapter 7, your lender can immediately gather the entire balance owed when the bankruptcy situation shut by garnishing your earnings, levying your checking account, or perhaps confiscating property - Tulsa OK bankruptcy attorney. Instead, you can use the Chapter 13 plan to pay these financial debts off over three to 5 years without the danger of severe collection actions hanging over your head

By contrast, if you file for Phase 13 personal bankruptcy, the creditor will leave your codebtor alone if you maintain up with your personal bankruptcy strategy repayments and pay the debt in complete.

In Phase 13 bankruptcy, you do not have to give up any type of home. If you have nonexempt building you can not birth to part with and can manage to pay to maintain it, Chapter 13 insolvency could be the better choice.

See This Report on Chapter 13 Bankruptcy Lawyer Tulsa

A cramdown minimizes the amount you owe to the collateral's real worth, so it functions excellent when you owe more than the building is worth. Here are the catches. A cramdown doesn't apply to the home you live in, and you must pay the whole lower balance via the payment plan.

If you marketed the residence, the sales proceeds wouldn't completely pay the first home mortgage, so there 'd be nothing to pay toward the 2nd.

If you marketed the residence, the sales proceeds wouldn't completely pay the first home mortgage, so there 'd be nothing to pay toward the 2nd.Some Known Incorrect Statements About Tulsa Debt Relief Attorney

In Chapter 13 personal bankruptcy, you must pay your lenders every one of your disposable incomethe amount remaining after enabled month-to-month expensesfor 3 to five years. Disposable earnings is the amount that remains after subtracting permitted bankruptcy expenditures from your month-to-month gross income. When you claim your deductions, you can use the actual expense of some costs and the national and regional requirements for others, such as the allocation for food, apparel, and housing.

Otherwise, you will not qualify.

Listed below, you'll discover even more write-ups describing exactly how insolvency functions. We totally encourage research and discovering, but on-line articles can't deal with all bankruptcy problems or the truths of your situation.

The Only Guide to Affordable Bankruptcy Lawyer Tulsa

If your income goes beyond that quantity, a means examination is called for to determine Phase 7 qualification. The test contrasts your household revenue and costs to median values for your community. If the examination finds financial means that surpass a legal limit, your Phase 7 filing is said to have an anticipation of abuse.

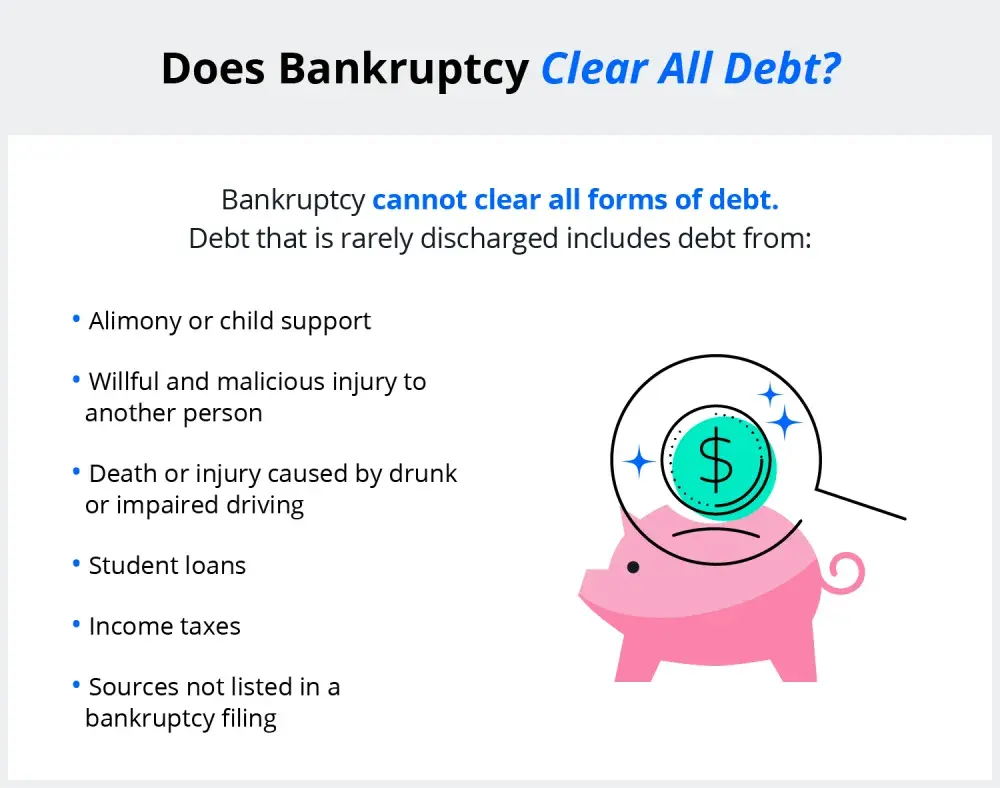

You can get Phase 13 insolvency if you have normal revenue and your total secured and unsecured financial obligations are much less than $2,750,000 (the limitation for 2024) on the date you file for bankruptcy. No. Neither Chapter 7 nor Chapter 13 insists on settlement of all impressive financial official statement debts. In Chapter 7, if you have assets of value in unwanted of the amount excluded by state and government legislation, they are offered and the earnings are distributed to your lenders.

You can get Phase 13 insolvency if you have normal revenue and your total secured and unsecured financial obligations are much less than $2,750,000 (the limitation for 2024) on the date you file for bankruptcy. No. Neither Chapter 7 nor Chapter 13 insists on settlement of all impressive financial official statement debts. In Chapter 7, if you have assets of value in unwanted of the amount excluded by state and government legislation, they are offered and the earnings are distributed to your lenders.Due to the fact that personal bankruptcy affects firms extremely differently than individuals, small company owners will certainly likewise wish to discover local business personal bankruptcy technique. Considering the highlights of Chapters 7 and Phase 13 is a great means to learn more about insolvency differences.: A Chapter 7 bankruptcy discharges most sorts of unsafe debt.

Not known Details About Bankruptcy Law Firm Tulsa Ok

: Many Chapter 7 debtors keep all or a lot of their residential or commercial property utilizing personal bankruptcy exemptions. Petitioners with nonexempt building can shed it to please some debts. Companies aren't entitled to keep residential property utilizing exemptions.: The trustee does not offer building in Chapter 13 insolvency. You pay lenders the worth of the nonexempt residential property you can not secure with a personal bankruptcy exemption through the payment plan.

Hanson & Hanson Law Firm, PLLC

Address: 4527 E 91st St, Tulsa, OK 74137, United StatesPhone: +19184090634

Click here to learn more

Report this page